Explore the best health insurance plans USA 2025. Find affordable, reliable coverage for individuals, families, and seniors with trusted providers.

Health Insurance in USA 2025: Affordable Plans & Complete Coverage Guide

Health insurance is a vital aspect of modern life, providing financial protection against unexpected medical expenses. In the USA, medical costs are constantly rising, and having a robust health insurance plan can save families from enormous debt while ensuring access to quality healthcare. Health insurance covers hospitalization, doctor consultations, prescription drugs, preventive care, and in some cases, dental and vision services.

Investing in a health insurance plan is not just about covering medical bills—it’s about securing peace of mind, safeguarding family members, and maintaining financial stability. Without health insurance, individuals are vulnerable to catastrophic medical expenses that can deplete savings and create long-term financial strain.

Healthcare in the USA can be complex, and insurance policies differ based on coverage, premiums, deductibles, co-payments, and network hospitals. Understanding the nuances of health insurance is crucial to selecting a plan that meets your family’s specific needs.

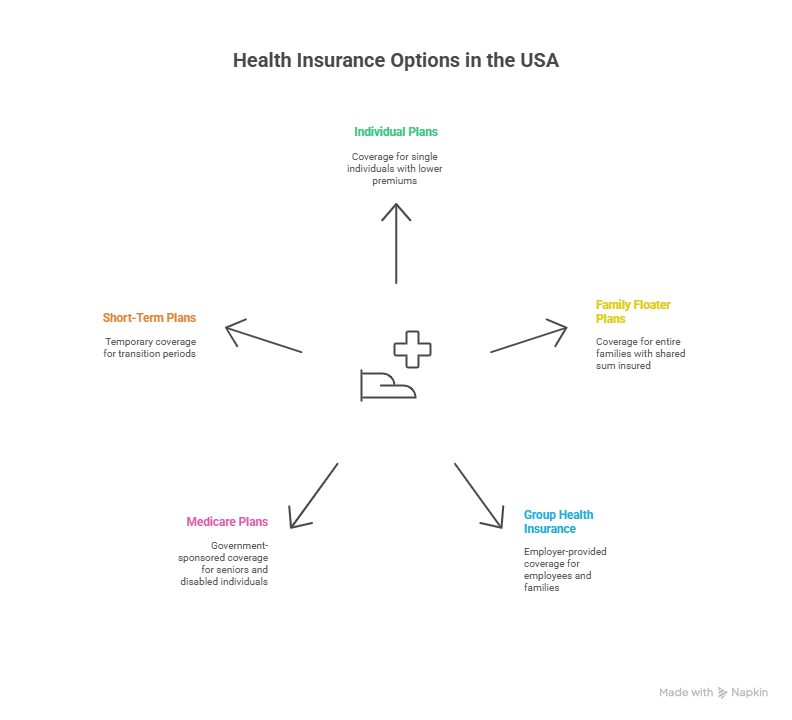

Types of Health Insurance Policies for Families in USA

Families in the USA have access to a variety of health insurance plans designed to cater to different requirements and budgets. Choosing the right plan is critical for comprehensive coverage and cost-effectiveness. Below are some of the most common types:

- Individual Health Insurance Plans

- Coverage is provided for a single person.

- Ideal for single adults, young professionals, or independent members.

- Premiums are generally lower than family plans but do not cover dependents.

- Coverage is provided for a single person.

- Family Floater Plans

- A single sum insured covers the entire family.

- Offers cost efficiency when multiple members require coverage.

- Sum insured is shared, which could be limited if multiple members require simultaneous treatment.

- A single sum insured covers the entire family.

- Group Health Insurance

- Offered by employers for their employees.

- Covers employees and sometimes immediate family members.

- Usually includes benefits like preventive care and wellness programs.

- Offered by employers for their employees.

- Medicare Plans

- Government-sponsored insurance for seniors (65+) or certain disabled individuals.

- Includes hospital (Part A) and medical coverage (Part B), with optional prescription drug plans.

- Government-sponsored insurance for seniors (65+) or certain disabled individuals.

- Short-Term Health Insurance

- Provides temporary coverage, ideal during transition periods or job changes.

- Often excludes pre-existing conditions and has limited benefits.

- Provides temporary coverage, ideal during transition periods or job changes.

Why Families Should Choose the Right Plan

- Protects family members from financial strain due to medical emergencies.

- Ensures access to quality healthcare facilities.

- Offers preventive care options, reducing long-term health risks.

- Can cover maternity, pediatric, and chronic illness treatments under specific policies.

What is Health Insurance?

Health insurance is a contractual agreement between an individual and an insurance company where the insurer promises to cover medical costs in exchange for regular premium payments. This system is designed to safeguard individuals and families against high medical expenses.

Key Features of Health Insurance

- Premium: The amount paid monthly or annually for coverage.

- Deductible: The amount you pay out-of-pocket before insurance begins to cover costs.

- Co-payment & Co-insurance: A portion of expenses shared between insured and insurer.

- Network Hospitals: Facilities where treatment costs are partially or fully covered by the insurer.

Benefits of Health Insurance

- Financial Security

- Covers hospitalization, surgery, doctor visits, and medications.

- Reduces the risk of medical debt and financial instability.

- Covers hospitalization, surgery, doctor visits, and medications.

- Access to Quality Healthcare

- Network hospitals provide cashless treatments.

- Preventive screenings and wellness programs are included in many plans.

- Network hospitals provide cashless treatments.

- Peace of Mind

- Knowing that unexpected medical emergencies will not cause financial strain.

- Encourages proactive health management.

- Knowing that unexpected medical emergencies will not cause financial strain.

- Tax Benefits

- Premiums paid for health insurance are often tax-deductible under US law.

- Encourages individuals and families to maintain coverage.

- Premiums paid for health insurance are often tax-deductible under US law.

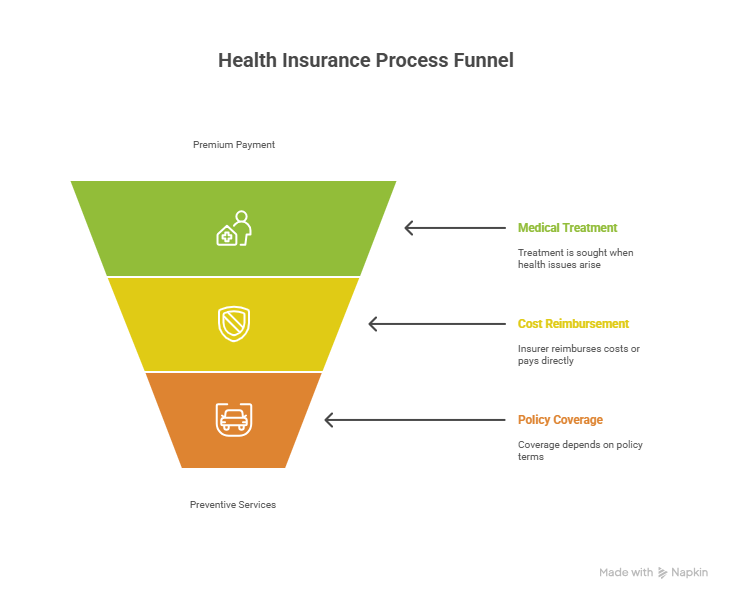

How Health Insurance Works

- Individuals pay a premium monthly or annually.

- When medical treatment is required, the insurer either reimburses costs or provides direct payment to the hospital (cashless).

- Policy coverage depends on terms like sum insured, exclusions, and network hospitals.

- Preventive services, such as vaccines and screenings, are often included, depending on the policy type.

Why Do You Need Health Insurance?

Health insurance is essential because medical expenses in the USA can be prohibitively high. A single hospitalization can cost tens of thousands of dollars, and chronic illnesses can require ongoing, expensive treatments.

Key Reasons for Health Insurance:

- Protection Against Financial Risks: Avoid unexpected medical bills.

- Access to Preventive Care: Early detection reduces long-term healthcare costs.

- Peace of Mind: Knowing your family is covered in emergencies.

- Legal Compliance: Some states may require minimum coverage under healthcare regulations.

Investing in health insurance ensures that you and your family do not compromise on necessary medical care due to financial limitations.

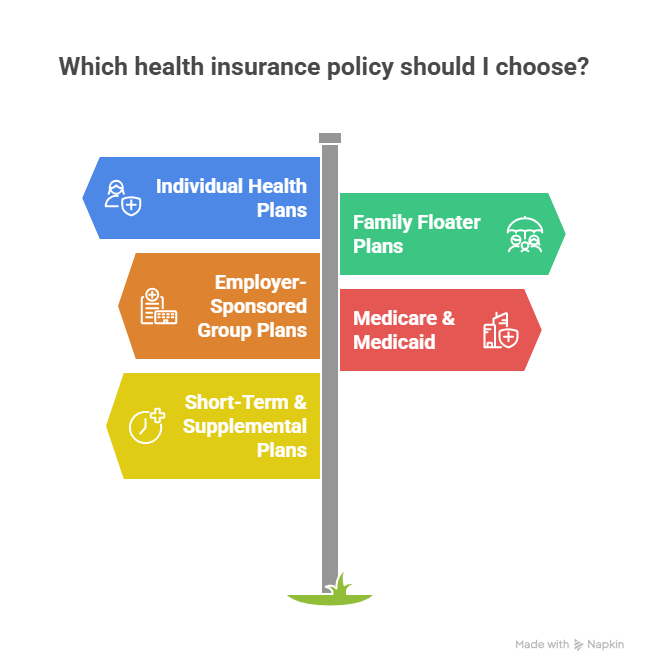

Which Health Insurance Policies Are Available Now in the USA?

There are multiple types of policies tailored to individual and family needs:

- Individual Health Plans – Cover a single adult or dependent.

- Family Floater Plans – Covers multiple family members under a single policy.

- Employer-Sponsored Group Plans – Offered by companies to employees and their families.

- Medicare & Medicaid – Government-funded health programs for seniors and low-income individuals.

- Short-Term & Supplemental Plans – Temporary or additional coverage for specific needs.

Each type offers distinct benefits, and choosing the right plan requires evaluating family size, health conditions, and financial considerations.

What is the Difference Between Individual Plan vs Family Floater Plan?

| Feature | Individual Plan | Family Floater Plan |

| Coverage | Only for one person | Covers entire family under one sum insured |

| Premium | Lower than floater for one person | Higher than individual but cost-effective for multiple members |

| Sum Insured | Fixed per person | Shared among family members |

| Claims | Individual claims only | Claims can reduce overall sum insured for other members |

| Ideal For | Single adults | Families with multiple dependents |

How to Claim for Health Insurance Coverage?

Claiming health insurance involves following specific steps to ensure smooth reimbursement or cashless settlement:

- Inform the Insurer: Notify the insurance company immediately about hospitalization.

- Collect Documents: Gather policy documents, hospital bills, prescriptions, and diagnostic reports.

- Submit Claim Form: Fill out the insurer’s claim form accurately.

- Approval Process: Insurer evaluates documents and may require additional verification.

- Reimbursement or Cashless Settlement: Payment is made either directly to the hospital or reimbursed to the insured.

Coverage Details

| Coverage Type | Individual Plan | Family Floater Plan | Notes |

| Hospitalization | ✔ | ✔ | Up to sum insured |

| Pre & Post Hospitalization | ✔ | ✔ | Typically 30-60 days covered |

| Daycare Procedures | ✔ | ✔ | Includes minor surgeries |

| Maternity | ✖ | ✔ | Optional add-on |

| Critical Illness | Optional | Optional | Extra premium may apply |

| Preventive Health Checkup | ✔ | ✔ | Annually or as per policy |

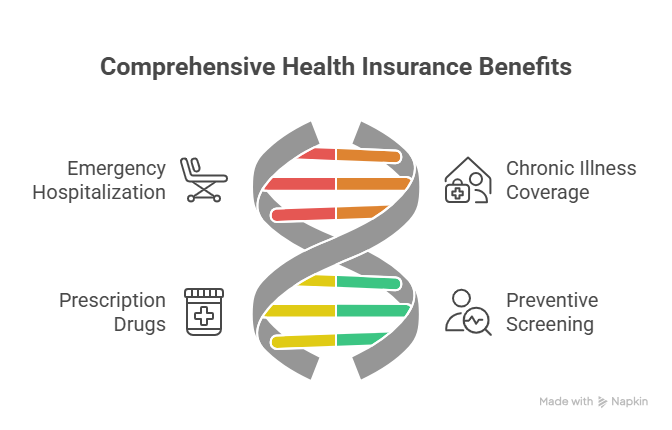

Financial Protection Against High Medical Costs

Health insurance provides significant financial protection against unpredictable medical expenses. With hospitalization costs rising every year, a comprehensive insurance policy ensures that you do not deplete your savings for medical emergencies.

- Emergency Hospitalization: Insurance covers surgery, ICU, and specialized treatment costs.

- Chronic Illness Coverage: Conditions like diabetes or heart disease require long-term care, which is often expensive.

- Prescription Drugs: Many policies reimburse or provide cashless access to medications.

- Preventive Screening: Early detection of diseases can prevent costly treatments later.

Looking for Medicare Coverage?

Medicare is a government-funded program providing healthcare coverage for seniors and certain disabled individuals. Medicare includes several parts:

- Part A: Hospital insurance covering inpatient care.

- Part B: Medical insurance covering outpatient services, doctor visits, and preventive care.

- Part C (Medicare Advantage): Optional private plans offering additional benefits like vision, dental, and wellness programs.

- Part D: Prescription drug coverage.

Choosing the right Medicare plan ensures seniors receive optimal medical care without financial burden.

Compare Quotes

- Obtain multiple insurance quotes online to compare premiums, coverage, and network hospitals.

- Check for hidden charges or limitations.

- Review benefits like maternity, dental, and preventive care.

- Evaluate deductibles and co-payment clauses.

- Choose a plan that balances coverage needs with affordability.

FAQ

FAQ 1: What is the average cost of health insurance in the USA?

Answer: Premiums vary based on age, location, coverage type, and pre-existing conditions. Individual plans average $300-$500/month, while family floater plans range from $700-$1500/month.

FAQ 2: Can I switch my health insurance policy mid-year?

Answer: Yes, but it depends on policy terms. Special enrollment periods and employer-sponsored plans allow changes during specific windows.

FAQ 3: Are pre-existing conditions covered?

Answer: Some plans cover pre-existing conditions after a waiting period, while others may exclude them. Always check the policy details.

FAQ 4: Does health insurance cover dental and vision?

Answer: Standard policies usually exclude dental and vision. Some plans or add-ons provide partial coverage.

FAQ 5: Can I get tax benefits for health insurance?

Answer: Yes, premiums paid for qualifying health insurance plans are tax-deductible under federal law.FAQ 6: What is a deductible in health insurance?

Answer: A deductible is the amount the insured must pay out-of-pocket before the insurer covers medical expenses.