Discover the list of top insurance companies in the USA for 2025, including life insurance, health coverage, general insurance, and corporate policies. Compare features, benefits, and plans to secure your financial future today.

List of Insurance Companies in USA

The United States has one of the largest and most competitive insurance markets in the world. Insurance companies in the USA provide a wide range of services, including life insurance, health coverage, property and casualty insurance, and investment-linked policies. Whether you are looking for individual coverage, corporate plans, or microinsurance products, the U.S. insurance sector offers numerous options to suit every financial and personal need.

Some of the top-performing insurance companies in the USA include:

- State Farm Insurance

- Allstate Corporation

- MetLife, Inc.

- Prudential Financial

- New York Life Insurance

- UnitedHealth Group

- AIG (American International Group)

- Progressive Corporation

- Nationwide Mutual Insurance

- Liberty Mutual Group

With thousands of insurers operating nationwide, understanding the different categories — public sector, private sector, and specialized insurance — is essential for choosing the right plan.

When searching for reliable protection, many people compare different insurance companies to find the best coverage for their needs. Choosing the right insurance companies is essential, as they provide financial security and peace of mind for families, individuals, and businesses alike. Top insurance companies in the USA offer a wide variety of plans, including life, health, auto, and home insurance, all designed to meet diverse customer needs.

Reputable insurance companies focus not only on competitive premiums but also on delivering excellent customer service and fast claim settlements. Leading insurance companies such as State Farm, Aetna, Progressive, and UnitedHealth have built trust over the years by consistently meeting client expectations. Many of these insurance companies offer additional benefits such as wellness programs, roadside assistance, and personalized policy recommendations.

Affordable insurance companies also provide flexible options to fit different family budgets and lifestyles. By tailoring policies, these insurance companies ensure customers pay for only what they need without compromising on coverage. In today’s digital age, most insurance companies utilize online tools and mobile apps, making policy management, premium payments, and claims processing easier and faster than ever before.

Trusted insurance companies prioritize financial stability, making it easier for policyholders to rely on them during emergencies. Many insurance companies provide educational resources, helping customers understand the details of their policies, coverage options, and potential risks. By comparing top insurance companies, individuals can make informed decisions and choose plans that align with their long-term goals.

In addition, leading insurance companies regularly update their policies to adapt to changing regulations, healthcare needs, and technological advancements. They also offer discounts, loyalty programs, and bundled coverage for multiple policies, which makes their services more affordable and attractive. Customers can explore different insurance companies to find specialized plans, such as senior health coverage, high-risk auto insurance, or family life insurance packages.

Ultimately, the right insurance companies provide more than just a policy—they offer protection, confidence, and a sense of security for every stage of life. By carefully researching and comparing multiple insurance companies, you can ensure that your family, assets, and future are well-protected. Choosing the best insurance companies today will help you enjoy peace of mind for years to come.

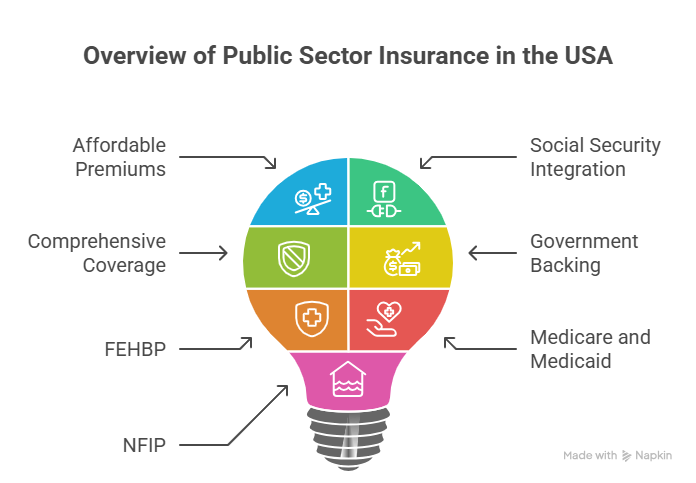

Insurance companies in Public Sector

Public sector insurance companies in the USA are either fully owned or significantly managed by the government. These companies typically offer policies that aim to provide broader coverage at competitive rates.

Some key features of public sector insurance companies:

- Affordable Premiums: Designed to be accessible to low- and middle-income groups.

- Social Security Integration: Often linked with federal and state social security programs.

- Comprehensive Coverage: Includes life, health, and pension plans.

- Government Backing: Financial security is enhanced due to state and federal oversight.

Examples include:

- Federal Employees Health Benefits Program (FEHBP) – Provides healthcare insurance to federal employees and retirees.

- Medicare and Medicaid Services – Offers healthcare coverage for senior citizens and low-income families.

- National Flood Insurance Program (NFIP) – Provides flood coverage where private insurers are limited.

Public sector insurance policies are ideal for those seeking stable, low-risk coverage with the backing of government resources.

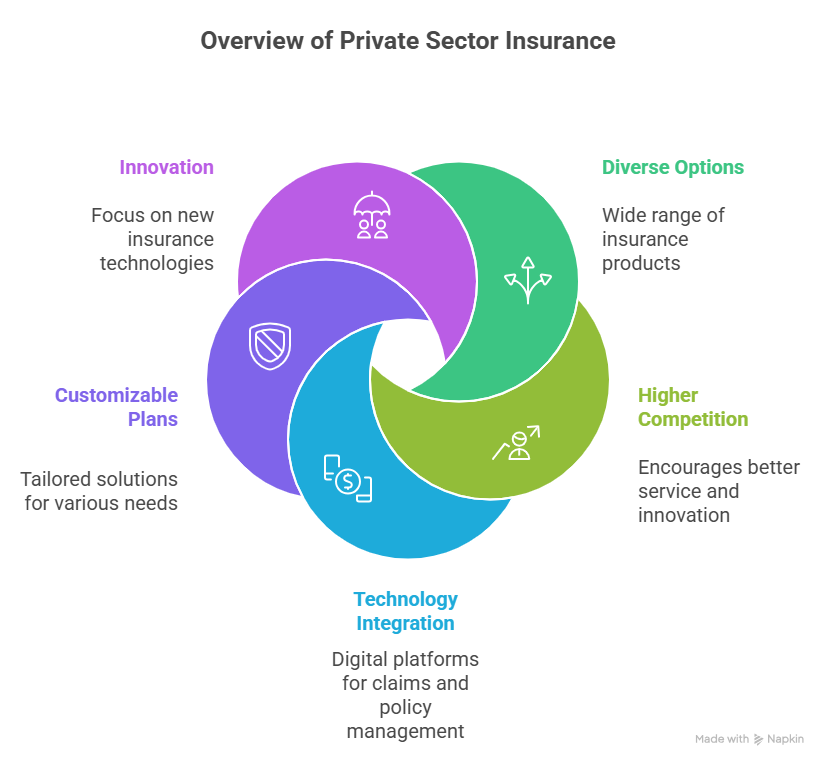

Insurance companies in Private Sector (Non-Life/General Insurance)

Private sector insurance companies dominate the U.S. insurance landscape. These firms provide non-life and general insurance products, ranging from vehicle and home coverage to liability and business protection plans.

Key Highlights of Private Sector Insurance:

- Diverse Options: Covers auto, property, accident, liability, travel, and more.

- Higher Competition: Encourages better customer service and innovative products.

- Technology Integration: Digital platforms for easy claims processing and policy management.

- Customizable Plans: Tailored solutions for individuals, families, and businesses.

Leading private general insurers include:

- State Farm

- Allstate

- Progressive

- Liberty Mutual

- Travelers Insurance

- Chubb

These companies focus heavily on innovation, offering usage-based car insurance, smart home coverage discounts, and AI-powered claim settlements.

Life Insurance Corporation in USA

Life insurance companies in the USA provide a range of products designed to secure the financial future of individuals and families. Life insurance acts as a financial safety net, ensuring that beneficiaries are protected in case of unforeseen circumstances.

Types of Life Insurance Products:

- Term Life Insurance – Coverage for a fixed period (10, 20, or 30 years).

- Whole Life Insurance – Lifetime coverage combined with a savings component.

- Universal Life Insurance – Flexible premiums and death benefits.

- Variable Life Insurance – Investment-linked policies offering higher returns.

Why Life Insurance is Crucial:

- Protects your family from financial hardships.

- Covers outstanding debts like mortgages and loans.

- Supports children’s education and future goals.

- Acts as a tax-saving investment tool.

Top Life Insurance Providers in the USA:

| Company Name | Founded | Headquarters | Best For |

| New York Life | 1845 | New York, NY | Whole life plans |

| MetLife | 1868 | New York, NY | Employee benefits |

| Prudential Financial | 1875 | Newark, NJ | Term life coverage |

| Northwestern Mutual | 1857 | Milwaukee, WI | Wealth management |

| MassMutual | 1851 | Springfield, MA | Retirement planning |

Choosing the right life insurance company depends on your goals — whether it’s wealth accumulation, education savings, or financial protection.

Met Life (USA)

MetLife, established in 1868, is one of the largest life insurance providers in the USA. The company offers a variety of life, health, and employee benefit plans tailored to individual and corporate needs.

Key Features of MetLife Policies:

- Global presence in over 40 countries.

- Provides dental, vision, disability, and accident insurance.

- Focuses on employee benefit programs for businesses.

- Offers customizable life insurance with flexible premiums.

MetLife has gained popularity due to its customer-first approach, innovative digital platforms, and competitive premium rates.

Corporate

Corporate insurance refers to policies designed for companies, startups, and large organizations. These plans protect businesses against financial risks and ensure workforce security.

Popular Corporate Insurance Types:

- Group Health Insurance – Covers employees’ medical expenses.

- Group Life Insurance – Ensures financial security for employees’ families.

- Business Interruption Coverage – Protects revenue during operational disruptions.

- Directors’ & Officers’ Liability Insurance – Shields management from legal claims.

Corporate insurance strengthens employee retention, enhances company credibility, and provides financial stability in times of crisis.

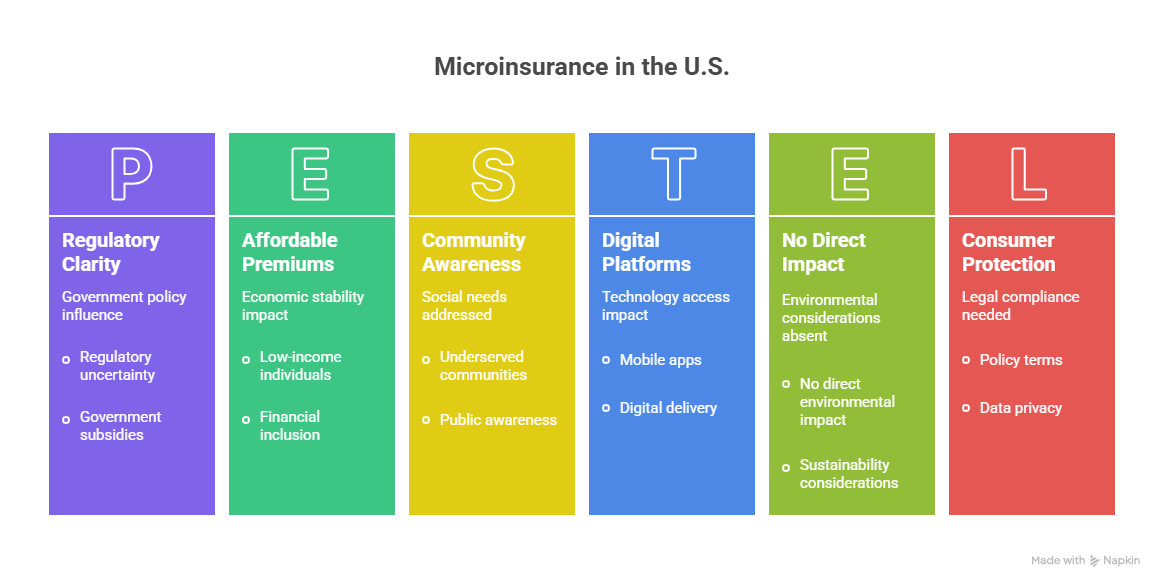

Microinsurance

Microinsurance is a type of insurance designed to be affordable and accessible for low-income individuals or those with irregular income. While it has traditionally gained traction in developing countries, where large portions of the population lack access to traditional insurance products, microinsurance is slowly emerging in the United States to address gaps in coverage for underserved communities.

The concept focuses on providing smaller, low-premium insurance products that offer basic protection against specific risks—such as health emergencies, accidents, job loss, or even funeral expenses. These policies are tailored for people who might not be able to afford standard insurance plans or who fall outside eligibility for public programs like Medicaid. In the U.S., microinsurance can serve populations such as part-time workers, gig economy participants, immigrants, or individuals in rural areas, many of whom lack consistent employer-sponsored benefits.

Microinsurance in the U.S. is often delivered through partnerships between insurers, non-profits, community organizations, and digital platforms. Some companies offer micro health insurance plans through mobile apps or prepaid cards, with coverage for doctor visits, telehealth, or urgent care services. Others may offer accident-only insurance or hospital indemnity plans that provide a fixed payout per day of hospitalization. Unlike traditional insurance, microinsurance policies are typically simplified, with minimal paperwork, short-term commitments, and easy onboarding processes—features that are essential for building trust with underserved communities.

While the microinsurance market is still in its infancy in the U.S., it holds significant potential as a tool for closing the protection gap. As healthcare costs continue to rise, and with millions of Americans either uninsured or underinsured, microinsurance could play an important role in making basic coverage more inclusive and equitable. For it to grow, however, there will need to be more regulatory clarity, public awareness, and innovative partnerships between insurers and community-based organizations.

- Microinsurance is a growing trend in the USA, designed for low-income individuals who cannot afford standard insurance plans. These policies focus on basic coverage at minimal premiums.

Features of Microinsurance:

- Extremely low-cost premiums.

- Covers essentials like health, accidents, and crop damage.

- Simplified documentation for easy access.

- Encourages financial inclusion.

Examples include Accident Protection Plans, Health Savings Accounts (HSAs), and Affordable Care Act (ACA) micro health policies.

Children Education Security Plan

This plan ensures that a child’s education continues even if the parent is no longer around. Benefits include:

- Lump sum payout on the policyholder’s death.

- Tax-saving opportunities.

- Multiple premium payment options.

Pension Policy

Offers post-retirement financial stability with guaranteed monthly payouts.

Whole Life Insurance

Provides lifelong coverage with a savings component that accumulates over time.

Single Premium Policy

One-time payment option offering full coverage for the entire policy duration.

Assurance Cum Pension Policy

Combines life assurance with a post-retirement pension scheme.

Endowment Insurance (With Profits)

Ideal for individuals seeking both insurance protection and guaranteed returns.

Anticipated Endowment Insurance (With Profits)

Offers periodic payouts along with full maturity benefits.

Child Protection Policy

Secures a child’s future by funding education and other expenses.

Five Payments Endowment Insurance

Provides financial benefits in five equal installments over the policy term.

Double Protection Endowment

Doubles the sum assured in case of accidental death.

Small Savings Insurance

Encourages low-income families to develop long-term savings habits.

Family Savings & Income Insurance Plan

Combines protection with regular income benefits.

Monthly Savings Insurance (MSI)

Offers systematic investment with fixed monthly premiums.

Health and Protection

In the United States, maintaining good health is closely tied to having access to quality healthcare—something that is often made possible through health insurance. Unlike many other developed nations with universal healthcare systems, the U.S. relies heavily on private health insurance, employer-sponsored plans, and government programs such as Medicare and Medicaid. For many Americans, having health insurance determines whether they can afford routine care, preventive services, and emergency treatments. Insurance helps cover the cost of doctor visits, hospital stays, medications, diagnostic tests, and other vital services that would otherwise be prohibitively expensive. Without it, people often delay or avoid seeking care, which can lead to worsening health conditions and higher long-term costs. Moreover, insurance plans often include wellness incentives, preventive screenings, and chronic disease management programs, all designed to support long-term health. These features not only benefit individuals but also reduce the burden on the healthcare system by catching issues early. In essence, having health insurance in the U.S. is more than just a financial tool—it’s a gateway to comprehensive care, disease prevention, and overall well-being.

Protection Through Insurance: Safeguarding Against Financial and Medical Risk

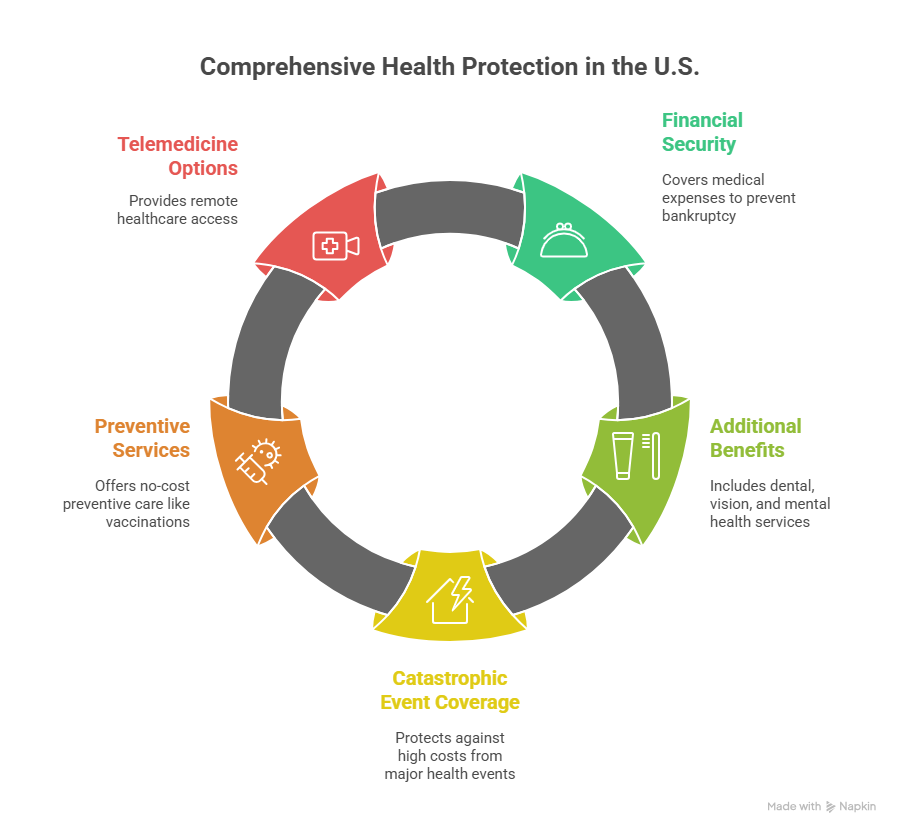

Health protection in the U.S. doesn’t just mean avoiding illness—it also means protecting yourself from the overwhelming costs that can come with medical emergencies, chronic conditions, or unexpected surgeries. This is where insurance serves as a crucial form of protection. Whether through employer-sponsored plans, Affordable Care Act (ACA) marketplaces, or public programs, insurance provides financial security by covering a large portion of medical expenses.

Beyond basic coverage, many insurance plans also offer protection through additional benefits like dental, vision, mental health services, and prescription drug coverage. Catastrophic health events, such as cancer diagnoses or major accidents, can bankrupt individuals without proper insurance coverage. Additionally, protections such as annual out-of-pocket maximums, no-cost preventive services under the ACA, and protections for people with pre-existing conditions provide a safety net that didn’t exist before the healthcare reforms of the last decade.

Insurance also facilitates access to essential preventive measures like vaccinations, cancer screenings, and maternal care, which are critical in safeguarding long-term health. Furthermore, some plans include telemedicine options, allowing people to receive care remotely, which increases access while reducing unnecessary exposure and travel. In the U.S., health insurance doesn’t just help pay for care—it is a vital form of protection that enables people to get the help they need, when they need it, without falling into financial ruin.

| Plan Name | Coverage Type | Eligibility | Key Benefits |

| Health Secure Plan | Health + Accident | All Ages | Cashless hospitalization |

| Premium Protection Plan | Life + Health | 18-60 Years | High claim settlement |

| Family Shield Insurance | Family Health | 21-55 Years | Covers spouse + children |

Financial Security?

Financial security is the ultimate goal of insurance. It ensures that your family remains financially independent even in uncertain times. Choosing policies with guaranteed returns, comprehensive coverage, and affordable premiums can safeguard your lifestyle.

Hospital Care

Hospital care plans cover medical expenses, room charges, and treatment costs during hospitalization, ensuring you receive the best care without financial burden.

FAQs

FAQ 1: Which are the top insurance companies in the USA?

Answer: State Farm, MetLife, Prudential, New York Life, and Progressive are among the leaders.

FAQ 2: What is the difference between public and private insurance?

Answer: Public insurance is government-backed, whereas private insurance is offered by independently owned companies.

FAQ 3: Which life insurance policy is best for families?

Answer: Whole Life Insurance and Endowment Policies are ideal for long-term family protection.

FAQ 4: How can I choose the right insurance plan?

Answer: Compare premiums, claim settlement ratios, policy benefits, and coverage limits before deciding.

FAQ 5: Is microinsurance worth considering?

Answer: Yes, especially for individuals seeking low-cost, basic protection.

FAQ 6: Do insurance plans help in tax savings?

Answer: Absolutely. Most life and health insurance premiums qualify for tax deductions under IRS guidelines.