Find comprehensive dental insurance in the USA. Compare top plans, find affordable coverage for individuals and families, and learn how to manage dental costs effectively.

Dental Insurance in USA – Maximize ROI with Top Plans for Growth & Conversion

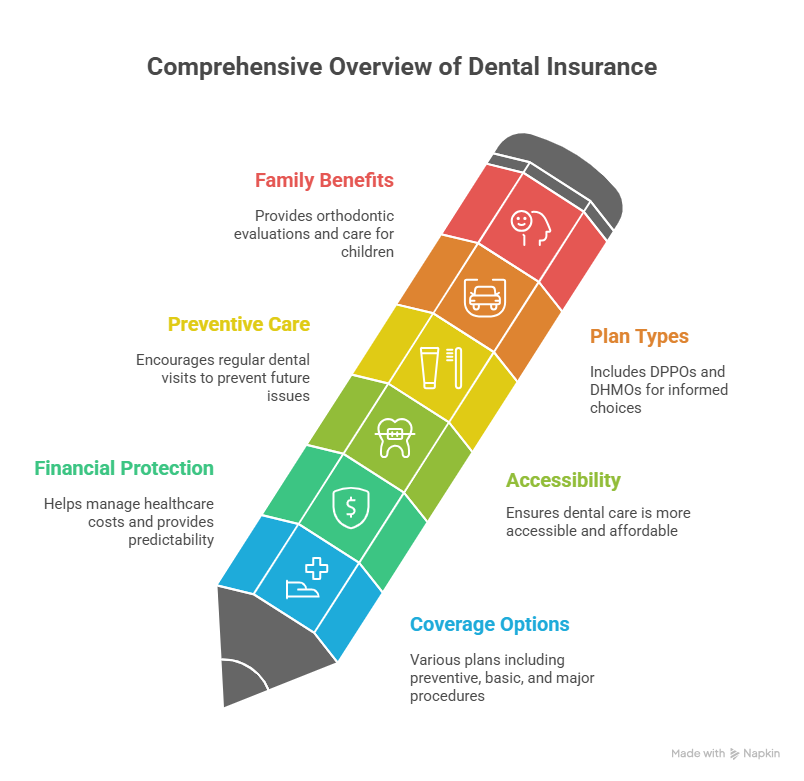

Dental insurance in the USA is a vital component of overall health coverage, as it ensures individuals and families have access to preventive care, routine check-ups, and treatment for dental problems. Oral health is closely linked to overall well-being, and untreated dental issues can lead to severe health complications. With rising healthcare costs, dental insurance provides financial protection and makes dental care more accessible and affordable.

In the United States, dental insurance is typically offered through employers, purchased individually, or obtained via government marketplaces. Plans vary widely in terms of coverage, cost, and provider networks, making it essential to compare options before choosing. Coverage usually includes preventive care like cleanings and X-rays, basic treatments such as fillings, and major procedures like crowns or dentures.

Dental insurance also plays a role in reducing long-term healthcare expenses. By covering preventive care, insurers encourage patients to maintain regular visits to dentists, reducing the likelihood of costly procedures later. Additionally, some dental insurance plans can be bundled with vision or supplemental health plans, creating a comprehensive care package.

For families, dental insurance ensures children receive orthodontic evaluations and preventive care during critical stages of development. For individuals, it offers peace of mind and financial predictability. Understanding different types of plans, such as Dental Preferred Provider Organizations (DPPOs) and Dental Health Maintenance Organizations (DHMOs), helps in making informed choices. Ultimately, dental insurance in the USA is not just about affordability—it’s about long-term health and financial security.

Dental Insurance Plans

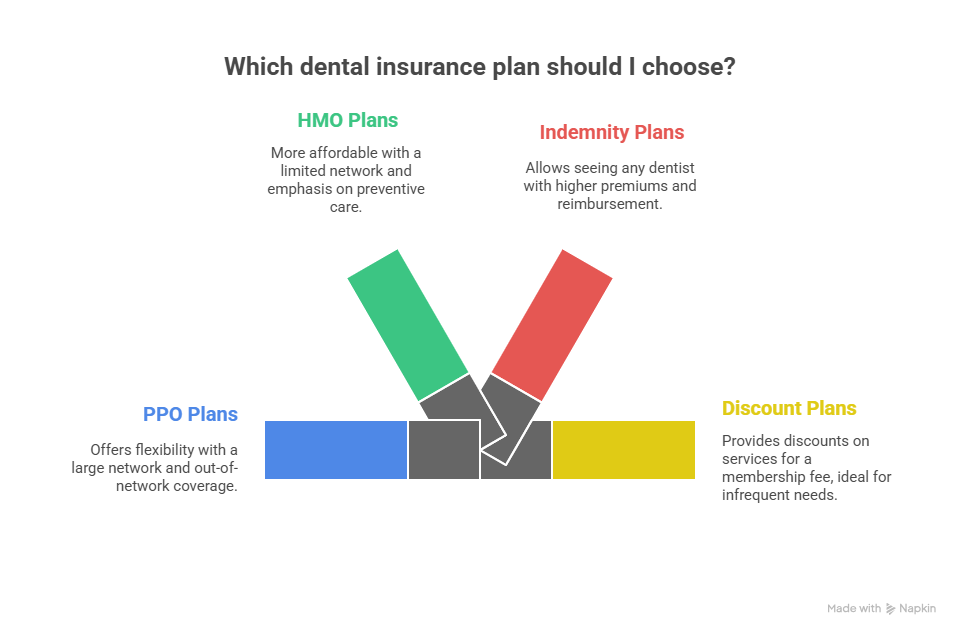

Dental insurance plans come in various forms, catering to different needs and budgets. These plans usually fall under categories such as PPO (Preferred Provider Organization), HMO (Health Maintenance Organization), indemnity plans, or discount plans. Each type offers unique benefits and limitations.

1. PPO Plans: Provide flexibility by allowing you to choose from a large network of dentists. They often cover a percentage of costs for out-of-network services.

2. HMO Plans: These are more affordable but require you to stay within a limited network of dentists. They usually emphasize preventive care.

3. Indemnity Plans: Often referred to as traditional insurance, these allow you to see any dentist and the plan reimburses a percentage of the cost. Premiums tend to be higher.

4. Discount Plans: Not traditional insurance, but provide discounts on dental services for a membership fee. Ideal for those without frequent dental needs.

Coverage in dental insurance plans typically comes in tiers:

- Preventive Care: 100% covered in most plans (cleanings, exams, X-rays).

- Basic Care: Fillings, extractions, and simple procedures (covered 70-80%).

- Major Care: Crowns, bridges, dentures, root canals (covered 50% or less).

- Orthodontics: Often limited to children, but some plans offer adult orthodontics with waiting periods.

Choosing the right plan depends on budget, dental needs, and network access. For families, orthodontic coverage is crucial. For individuals, preventive-focused plans may be enough. Employers often subsidize plans, while individuals purchasing on the marketplace need to carefully evaluate premiums, deductibles, and out-of-pocket maximums.

Find Dental Insurance Plans for Individuals & Families – Lead-Generating Coverage Built for ROI

Finding dental insurance plans tailored for individuals and families requires understanding both coverage needs and affordability. Families, for instance, often require plans that cover orthodontics, pediatric care, and preventive services. Individuals might prioritize affordability and comprehensive coverage for basic and major services.

Key considerations when choosing:

- Premiums vs. Coverage: Lower premiums often mean higher deductibles and fewer covered services.

- Network of Dentists: Ensure your preferred dentist is included in the network.

- Annual Maximums: Most plans cap coverage annually, usually between $1,000 and $2,500.

- Waiting Periods: Some plans have waiting periods for major procedures.

- Preventive Care: Look for plans that fully cover cleanings and exams.

For Individuals:

- Affordable options include PPOs with preventive focus.

- Discount plans are ideal for those with minimal needs.

- Consider high-coverage plans if you require frequent dental work.

For Families:

- Orthodontic coverage is key.

- Plans with higher annual maximums are beneficial.

- Flexible networks ensure access to pediatric dentists.

Example Family vs. Individual Plan Comparison:

| Plan Type | Individual | Family |

| Premium | $25–$45/mo | $75–$150/mo |

| Deductible | $50 | $150–$300 |

| Annual Max | $1,000–$1,500 | $2,000–$3,500 |

| Orthodontics | Optional, limited | Often included |

Choosing wisely ensures both affordability and adequate protection. Families especially benefit from bundled packages combining dental, vision, and supplemental health coverage.

View Dental Plans with High Conversion Potential – Tailored for Decision-Makers & Buyers

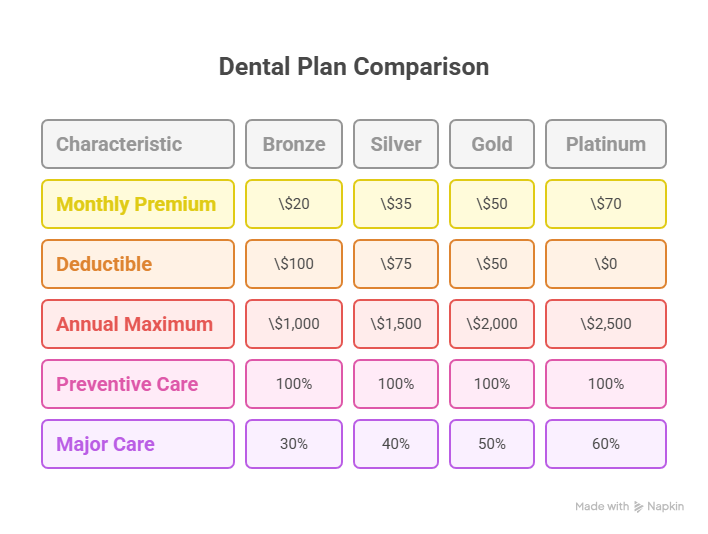

When viewing dental plans, understanding the key elements of coverage, cost, and network is crucial. Insurance companies often categorize their offerings into tiered options such as Bronze, Silver, Gold, and Platinum, similar to health insurance plans. Each tier represents different balances of monthly premiums versus out-of-pocket expenses.

Plan Structures:

- Bronze Plans: Lowest premiums but highest deductibles; preventive care usually covered.

- Silver Plans: Moderate premiums and deductibles; more coverage for basic care.

- Gold Plans: Higher premiums but lower deductibles; best for those with ongoing dental needs.

- Platinum Plans: Highest premiums with maximum coverage, often including orthodontics.

What to Look for When Viewing Plans:

- Monthly Premiums: Cost to maintain the plan.

- Deductibles: Out-of-pocket before insurance kicks in.

- Coinsurance/Co-payments: Your share of costs.

- Annual Maximum: Limit of coverage per year.

- Waiting Periods: Especially for major care.

Example Dental Plan Comparison

| Plan | Monthly Premium | Deductible | Annual Maximum | Preventive Care | Major Care |

| Bronze | $20 | $100 | $1,000 | 100% | 30% |

| Silver | $35 | $75 | $1,500 | 100% | 40% |

| Gold | $50 | $50 | $2,000 | 100% | 50% |

| Platinum | $70 | $0 | $2,500 | 100% | 60% |

Additional Considerations:

- Provider Network Size.

- Out-of-Network Coverage.

- Bundled Options with vision and supplemental plans.

By carefully reviewing available dental plans, individuals and families can maximize coverage while minimizing long-term costs.

What Do Dental Plans Cover? – Avoid Costly Gaps with a High-ROI Coverage Checklist

Dental plans generally cover three tiers of care: preventive, basic, and major services. The percentage of coverage varies depending on the insurer and the type of plan.

1. Preventive Services

- Dental exams

- Cleanings (2x per year)

- X-rays

- Fluoride treatments

2. Basic Services

- Fillings

- Tooth extractions

- Simple root canals

- Periodontal (gum) treatments

3. Major Services

- Crowns

- Bridges

- Dentures

- Complex oral surgeries

Orthodontic Coverage

- Often available for children under 18.

- Adult orthodontics may be offered with premium plans.

Coverage Breakdown Example

| Service Type | Typical Coverage |

| Preventive | 100% |

| Basic Care | 70–80% |

| Major Care | 40–50% |

| Orthodontics | Varies (20–50%) |

Exclusions

- Cosmetic procedures (whitening, veneers)

- Some implants

- Pre-existing condition limitations

Dental insurance helps reduce out-of-pocket costs, but understanding what is covered and excluded ensures no surprises. Always review the Summary of Benefits before enrolling.

Top Dental Insurance Plans for Buyers Seeking Maximum Value & Lead Generation Potential

Top dental insurance providers in the USA are known for their extensive networks, affordability, and comprehensive coverage. Here are some of the leading options:

Delta Dental

Delta Dental is the largest dental insurance provider in the U.S., covering over 80 million Americans. Known for its extensive network of dentists and affordable premiums, Delta Dental offers several plans:

- Delta Dental PPO – Flexible with in- and out-of-network options.

- Delta Dental Premier – A larger network with higher fee allowances.

- DeltaCare USA – A prepaid HMO-type plan with fixed copayments.

Pros:

- Huge nationwide dentist network

- 100% coverage for preventive care on many plans

- Strong reputation and reliability

Best For: Individuals, families, and employers looking for trusted, affordable dental care.

Cigna Dental Insurance – Enterprise-Trusted Coverage for Long-Term ROI & Patient Retention

Cigna Dental provides coverage to millions of members and offers both standalone dental plans and bundled options with health insurance. Popular plan types include:

- Cigna Dental Preventive – Covers routine checkups and cleanings.

- Cigna Dental 1000/1500 – Offers broader coverage including basic and major services.

Pros:

- No deductible for preventive services

- 24/7 customer service

- Access to a large national network

Best For: People looking for bundled health and dental plans or affordable preventive coverage.

MetLife Dental Plans – High-Conversion Features Backed by Enterprise Trust

MetLife Dental is a popular provider known for offering employer-sponsored plans, as well as individual coverage. Plans include:

- PPO Plans – Flexibility to visit any licensed dentist.

- HMO/Managed Care Plans – Lower costs with network-restricted options.

Pros:

- Strong PPO network

- Competitive rates for families

- Simple claims process

Best For: Employees and families seeking comprehensive dental benefits through work or individual plans.

Humana Dental Insurance – Lead-Driving Benefits That Optimize Growth for Families & SMBs

Humana Dental is known for offering a variety of dental plans that range from basic preventive care to full-coverage dental insurance:

- Preventive Plus Plan

- HumanaOne Dental Loyalty Plus

- Dental Value Plan (HMO)

Pros:

- Affordable monthly premiums

- Some plans include vision discounts

- No waiting periods on certain services

Best For: Seniors, individuals, and small businesses looking for customizable options.

UnitedHealthcare Dental – How to Choose Scalable Dental Coverage for ROI-Focused Buyers (Step-by-Step Guide)

UnitedHealthcare Denthttps://www.aetna.com/individuals-families/buy-dental-coverage.htmlal provides dental insurance as part of its larger health services network. They offer plans for individuals, families, and Medicare beneficiaries.

- Dental Primary Plan

- Dental Premier Choice

- Medicare Advantage Dental Add-Ons

- Wide network, customizable plans.

Comparison Table of Top Providers

| Provider | Network Size | Monthly Premium | Annual Max | Notable Features |

| Delta Dental | 150,000+ dentists | $30–$60 | $1,500–$2,500 | Strong orthodontic coverage |

| Cigna | 90,000+ | $25–$55 | $1,000–$1,500 | No-cost preventive care |

| MetLife | 120,000+ | $28–$50 | $1,000–$2,000 | Employer-focused plans |

| Humana | 70,000+ | $20–$45 | $1,000–$1,500 | Discount savings plans |

| UnitedHealthcare | 100,000+ | $35–$65 | $1,500–$2,500 | Wide national coverage |

Choosing among top providers requires evaluating personal needs, location, and whether orthodontic or major coverage is a priority.

Delta Dental Insurance – Top 2025 Trend: Cost-Efficient Coverage That Drives Conversions in Tier One Markets

Delta Dental is the largest dental insurance provider in the USA, offering coverage to millions of Americans. It provides both individual and employer-based plans, with a wide range of coverage options.

Key Features:

- Largest network of dentists nationwide.

- Flexible PPO and HMO plan options.

- Strong preventive care coverage.

- Comprehensive orthodontic coverage, including for adults.

- Affordable premiums with competitive annual maximums.

Example Delta Dental Plans

| Plan | Monthly Premium | Deductible | Annual Max | Preventive Care | Major Care |

| DeltaCare USA (HMO) | $20 | $0 | No limit | 100% | Limited |

| PPO Basic | $30 | $50 | $1,000 | 100% | 40% |

| PPO Premium | $60 | $50 | $2,500 | 100% | 50% |

Delta Dental’s reputation and expansive network make it a go-to option for families and individuals seeking comprehensive and affordable dental care.

Best Dental Insurance Plans – Expert Insight from U.S. Market Leaders on 72% ROI in Preventive Coverage

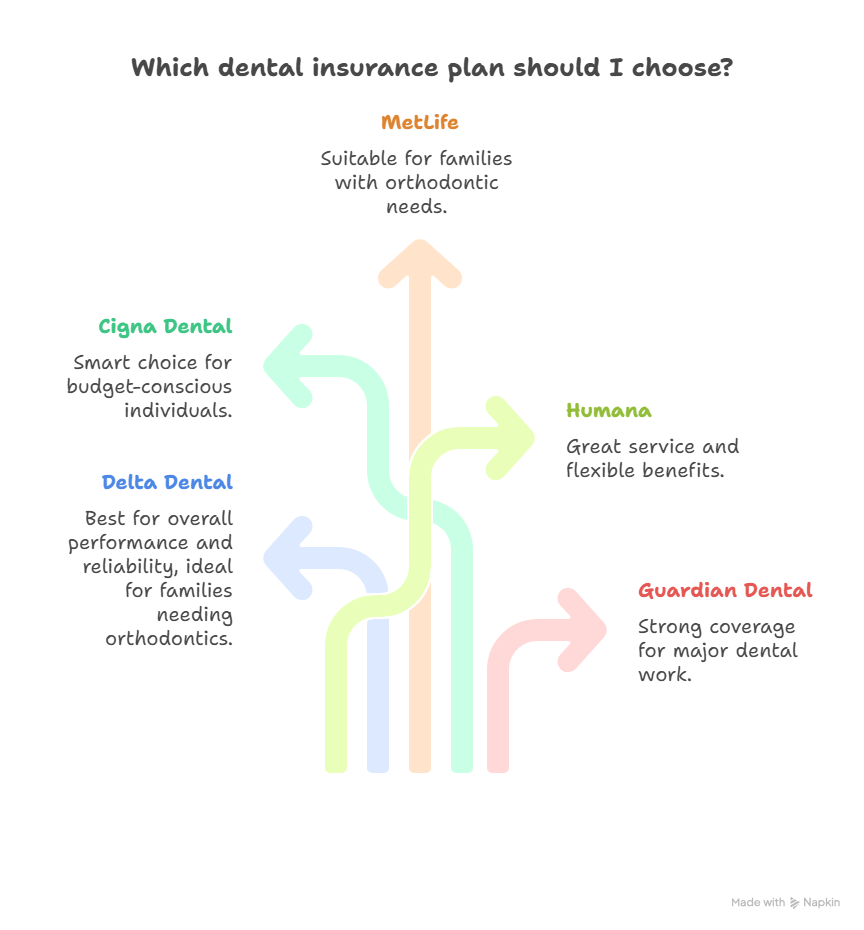

For overall performance and reliability, Delta Dental is hard to beat. If you’re budget-conscious, Cigna Dental is a smart choice. Families—especially those needing orthodontics—should check out MetLife. Humana is ideal for those who value great service and flexible benefits. And if you need major dental work, Guardian Dental provides strong coverage with appealing plan tiers.

Comparing quotes from eHealthInsurance, DentalPlans.com, or Healthcare.gov is a great next step to find the most cost-effective plan tailored to your needs.

Top Picks:

- Delta Dental PPO Premium: Best for families with orthodontic needs.

- **Cigna De

FAQs

What is the best dental insurance plan in the USA for ROI in 2025?

Explore high-ROI dental insurance options with maximum coverage for families and individuals.

How much does top-tier dental insurance cost in the US, Canada, and UK?

Detailed cost comparison to help buyers optimize value and conversion.

Which dental insurance providers offer the highest ROI for small businesses?

Compare enterprise-trusted dental providers for lead generation and team retention.

Best dental insurance plans with orthodontic coverage – What’s the ROI?

Top plans offering braces & cosmetic dentistry with measurable financial outcomes.

Dental insurance with the highest lead generation impact for brokers & consultants

Discover which providers convert best for white-labeled dental insurance services.

What services are included in high-growth dental insurance plans in 2025?

Checklist of core and optional services driving engagement in Tier One markets.

Top dental insurance plans by conversion rate – What drives clicks and policy sign-ups?

Review plans with proven high CTR and long-term retention metrics.

Which dental insurance providers are trusted most by enterprise buyers in the US and UK?

Insights into B2B trust signals that influence conversion.

How to choose a dental plan with strong lead generation potential?

Quick tips to help marketers and brokers select conversion-focused plans.

Best dental insurance jobs in lead generation & enterprise sales – What’s the growth outlook?

Explore careers with top dental insurers offering high commissions & performance ROI.