Explore the Health Insurance Marketplace to compare ACA plans, calculate premiums, and check eligibility for subsidies. Get the best coverage for you and your family today.

Affordable Health Insurance Marketplace Plans for Enterprise Buyers – Maximize ROI & Lead Generation

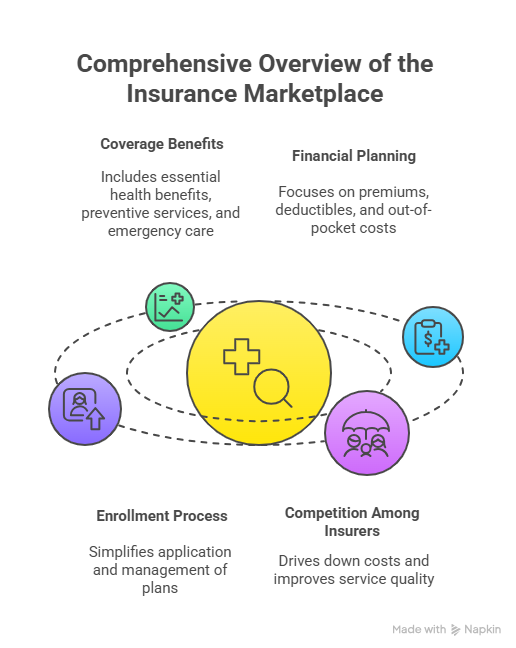

For individuals who may not have access to employer-provided insurance, the Insurance Marketplace provides an essential opportunity to obtain coverage. Through the Insurance Marketplace, plans cover essential health benefits, preventive services, prescription medications, and emergency care, ensuring peace of mind for families.

Understanding the Insurance Marketplace is not just about finding a policy—it’s about financial planning and long-term healthcare security. When selecting a plan from the Insurance Marketplace, it’s vital to consider premiums, deductibles, network coverage, and potential out-of-pocket costs. Consumers are encouraged to compare multiple options within the Insurance Marketplace to ensure they find the optimal balance between cost and coverage.

Additionally, the Insurance Marketplace simplifies the enrollment process by allowing applicants to submit a single application for multiple plans. Families using the Insurance Marketplace can easily manage their health coverage, renew plans annually, and adjust coverage based on life events such as marriage, birth, or job changes.

Lastly, the Insurance Marketplace fosters competition among insurers, helping to drive down costs while maintaining quality. Insurers competing within the Insurance Marketplace strive to offer better premiums, enhanced benefits, and improved service quality. This healthy competition ultimately benefits consumers with more affordable, flexible, and comprehensive healthcare options. options.

ACA Marketplace Plans for High-Growth Individuals and Businesses – Boost Coverage & Cut Costs

Health care insurance purchased through the Marketplace offers structured and regulated coverage options that comply with ACA guidelines. These plans provide essential coverage, ensuring protection against high medical costs and catastrophic health events.

Key features include:

- Coverage for pre-existing conditions: No denials or higher premiums.

- Essential health benefits: Including maternity, prescription drugs, mental health, and preventive care.

- Guaranteed renewability: Plans cannot be canceled due to health status.

- Financial Assistance: Many plans include subsidies for eligible individuals.

Marketplace plans are available for individuals, families, and small businesses. Each plan must provide minimum essential coverage and adhere to standardized benefits and cost-sharing. The ACA mandates that all plans cover at least 10 categories of essential health benefits, protecting consumers from unexpected financial burdens due to medical emergencies.

By purchasing insurance through the Marketplace, consumers gain access to a user-friendly platform, eligibility screening for subsidies, and tools to compare plans side-by-side. Plans are categorized into metal tiers—Bronze, Silver, Gold, and Platinum—allowing consumers to evaluate coverage based on premium costs and out-of-pocket expenses.

How to Get Insurance Through the ACA Health Insurance Marketplace – Step-by-Step for Buyers & Enterprises

Getting insurance through the Marketplace involves a series of steps designed to simplify the enrollment process while ensuring that applicants receive appropriate coverage:

- Create an Account: Start by visiting the official Marketplace website and setting up an account.

- Provide Personal Information: Include details about household size, income, and residency.

- Explore Plans: Compare available options based on coverage, premiums, deductibles, and network providers.

- Check Eligibility for Subsidies: Determine potential financial assistance through premium tax credits or cost-sharing reductions.

- Select a Plan and Enroll: Choose the plan that meets your needs and submit your application before the enrollment deadline.

- Confirmation & Payment: Receive confirmation and make the initial premium payment to activate coverage.

It’s crucial to adhere to open enrollment periods unless qualifying for special enrollment due to life events like marriage, childbirth, or loss of other coverage.

Health Insurance Marketplace Calculator – Project Costs, ROI & Premium Savings with Confidence

The Health Insurance Marketplace Calculator is a tool that estimates:

- Monthly premiums

- Eligibility for subsidies

- Estimated out-of-pocket costs

This calculator uses household income, family size, and location to provide a personalized projection, helping consumers make informed decisions about coverage.

Benefits of Using the Calculator:

- Quick estimates for planning your healthcare budget.

- Comparison of different plan types and metal levels.

- Eligibility insights for cost-sharing reductions and premium tax credits.

Navigating Medicare and the ACA Marketplace – Compliance & Optimization for Enterprise Decision-Makers

Medicare-eligible individuals typically do not use the Marketplace for coverage. However:

- Medicare and Marketplace overlap: Individuals turning 65 or qualifying for Medicare should consider whether Marketplace coverage or Medicare offers better benefits.

- Avoid penalties: Enrolling in Marketplace insurance while eligible for Medicare can result in unnecessary premiums and coverage conflicts.

Marketplace tools provide guidance for users navigating Medicare enrollment in coordination with Marketplace plans.

Find Out if You Are Eligible for a Health Insurance Marketplace Plan – Fast Track Eligibility for Top ROI

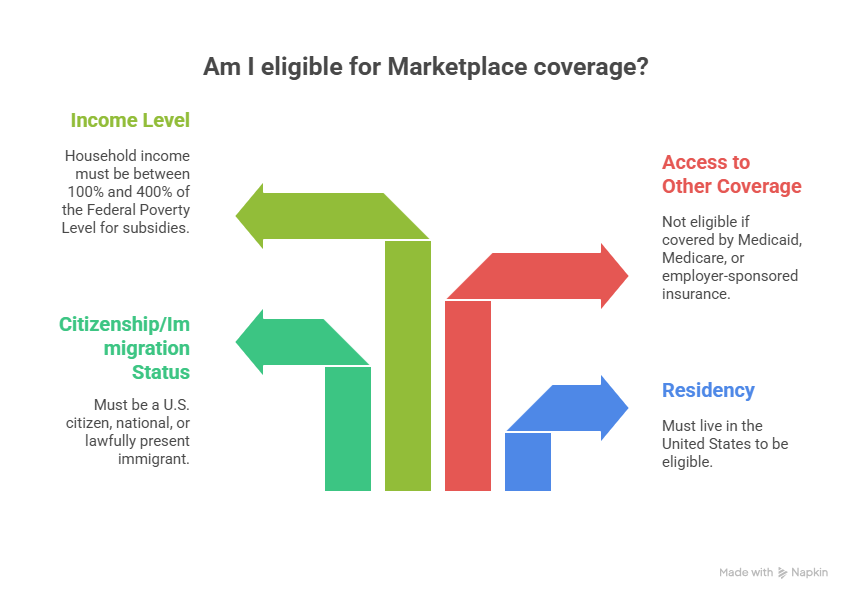

Eligibility for Marketplace coverage is determined by several factors:

- Residency: Must live in the United States.

- Citizenship or Immigration Status: U.S. citizens, U.S. nationals, or lawfully present immigrants.

- Access to Other Coverage: Not currently eligible for Medicaid, Medicare, or employer-sponsored insurance (with minimum coverage standards).

- Income Level: Household income must generally be between 100% and 400% of the Federal Poverty Level for subsidies.

Steps to Check Eligibility:

- Use the official Marketplace website for a pre-eligibility screening.

- Input household information: This includes family size, income, and location.

- Review results: The system provides details on available plans and potential financial assistance.

- Confirm eligibility: Final eligibility is determined upon plan application submission.

Eligibility may change annually or due to life events such as marriage, job loss, or moving states.

How Much is Insurance Through the Health Insurance Marketplace? – Cost Breakdown & Conversion Tips for High-Intent Buyers

The cost of Marketplace insurance varies based on factors like income, household size, plan tier, and location. The table below shows estimated monthly premiums for different metal levels (example for a 40-year-old individual in 2025):

| Plan Tier | Estimated Monthly Premium | Deductible | Out-of-Pocket Max |

| Bronze | $350 | $7,500 | $8,500 |

| Silver | $450 | $4,500 | $6,500 |

| Gold | $600 | $1,500 | $4,500 |

| Platinum | $750 | $500 | $3,500 |

Note: Premiums can be reduced with premium tax credits for eligible individuals.

Streamlined Enrollment Strategy for the ACA Marketplace – Increase Conversion & Trust with Data-Driven Insights

Enrollment in a Marketplace plan can be completed online, by phone, or with the help of a certified assister:

- Online: Visit HealthCare.gov or your state Marketplace site.

- By Phone: Speak with a Marketplace representative.

- In-person: Schedule an appointment with a local assister or navigator.

- Paper Application: Submit via mail if online enrollment is not preferred.

Enrollment requires verification of identity, income, and residency.

Policy Research Tools for Marketplace Plans – Empower Enterprise Decision-Makers with Actionable Intelligence

Policy research in the Marketplace context focuses on analyzing insurance coverage trends, evaluating cost and accessibility, and comparing plan performance:

- Study of premium changes over time

- Analysis of coverage gaps in different demographics

- Effectiveness of subsidies in reducing uninsured rates

- Quality ratings of insurers and plans

Well-structured research helps policymakers optimize Marketplace regulations and improves transparency for consumers.

Health Insurance Data & Features – Compare Plans with Real-Time Metrics to Drive Enterprise Growth

| Feature | Description |

| Plan Comparison | Side-by-side evaluation of premiums, deductibles, and benefits |

| Eligibility Checker | Tool for determining subsidy and coverage eligibility |

| Enrollment Management | Secure portal to manage existing coverage and renewals |

| Cost Estimator | Predict monthly premiums and out-of-pocket expenses |

| Provider Network Search | Find in-network doctors and hospitals |

These data-driven features improve consumer confidence and decision-making efficiency.

Forms & Instructions

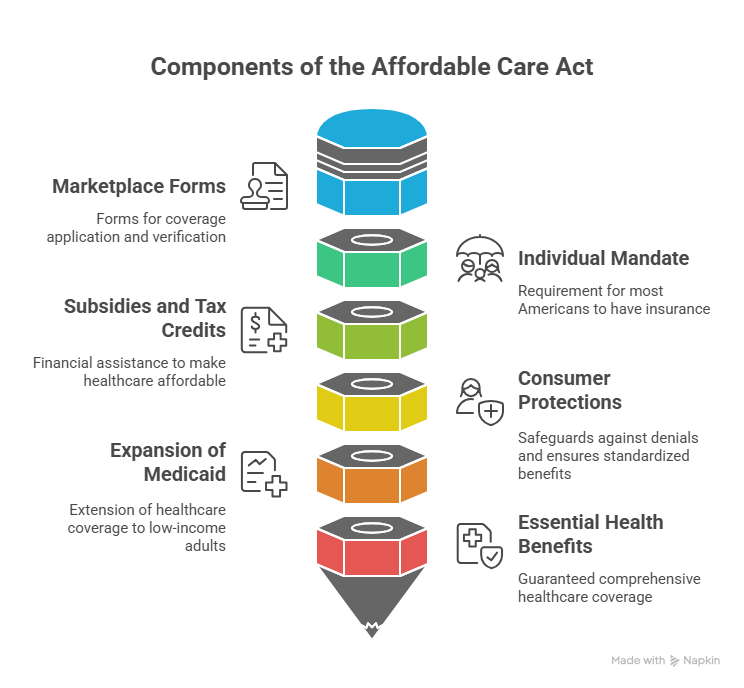

Marketplace forms include:

- Application forms: For new coverage or renewal

- Verification forms: To confirm income, identity, and citizenship

- Appeal forms: To dispute coverage decisions

- Change forms: To update household information or address life events

Clear instructions ensure applicants complete forms accurately, avoiding delays in coverage.

More In Affordable Care Act

The ACA reshaped the health insurance landscape by introducing:

- Individual mandate: Ensuring most Americans have insurance.

- Subsidies and tax credits: Making healthcare affordable.

- Consumer protections: No denials for pre-existing conditions, free preventive care, and standardized benefits.

- Expansion of Medicaid: For low-income adults in participating states.

- Essential health benefits: Guaranteeing comprehensive coverage.

These elements have contributed to increased insurance coverage, better preventive care utilization, and more predictable healthcare costs for American families.

Checklist: How to Choose the Best ACA Health Insurance Plan for Your Budget and ROI Goals

Choosing a plan involves:

- Assessing your needs: Consider medical history, prescription drugs, and planned procedures.

- Comparing premiums: Monthly cost versus out-of-pocket expenses.

- Checking networks: Ensure preferred doctors and hospitals are covered.

- Evaluating metal tiers: Bronze for lower premiums, Platinum for minimal out-of-pocket costs.

- Understanding subsidies: Eligibility may affect affordability.

Understanding Metal Levels and Marketplace Insurance – A Step-by-Step Guide for Tier-One Buyers

Marketplace insurance is categorized into metal levels:

- Bronze: Low premium, high deductible

- Silver: Moderate premium, eligible for cost-sharing reductions

- Gold: Higher premium, lower out-of-pocket costs

- Platinum: Highest premium, lowest out-of-pocket costs

Choosing a metal level requires balancing monthly affordability with expected healthcare usage.

Forms & Instructions for Marketplace Enrollment – Quick Tips to Maximize Efficiency and Coverage Trust

The Kaiser Family Foundation (KFF) Health Insurance Marketplace Calculator is an invaluable tool that allows you to estimate your premiums and potential financial aid. Here’s how it works:

- You input details such as household income, family size, age, zip code (location), and your eligibility for employer coverage or Medicaid.

- It then displays estimated premiums for the benchmark Silver plan (the second-lowest-cost silver plan in your area) and the lowest-cost Bronze plan.

- The calculator reflects age-based premium adjustments, capped by ACA rules (e.g., a 64-year-old can’t be charged more than 3× what a 21-year-old pays), and does not include tobacco surcharges.

Real-Time Premium Estimation Insights – Key Influencing Factors That Affect ACA ROI & Lead Generation

1. Household Income & Family Size

Subsidy eligibility depends largely on your Modified Adjusted Gross Income (MAGI) as a percentage of the Federal Poverty Level (FPL):

- Up to 150% FPL: expected contribution is 0% of income.

- 150–200%: ~0–2%

- 200–250%: ~2–4%

- 250–300%: ~4–6%

- 300–400%: ~6–8.5% (up to the cap)

- Above 400%: contribute up to 8.5% (enhanced subsidies in effect through 2025 may lower this)

For example, a family of four with a MAGI of $78,000 (250% of FPL) would have an expected annual contribution of 4%—$3,120. If the benchmark Silver plan costs $15,000 annually, their Premium Tax Credit (PTC) is $11,880 (i.e., $15,000 – $3,120) or about $990/month.

2. Location

Premiums vary widely by geography due to differences in healthcare costs and market conditions. These regional variations affect both the benchmark plan cost and your corresponding subsidy levels.

3. Age

Premiums increase with age, but ACA limits how much more older individuals can be charged (up to 3× the youngest rates), making subsidies particularly impactful for older adults.

4. Metal Level of Plan

- Bronze = Lowest premiums, highest out-of-pocket costs

- Silver = Mid-tier premiums/out-of-pocket; used as the benchmark for calculating subsidies

- Gold/Platinum = Highest premiums, lowest out-of-pocket

Premium tax credits can be used for any level, but cost-sharing reductions (further lowering deductible/copay costs) only apply to Silver plans if you’re between 100–250% FPL.

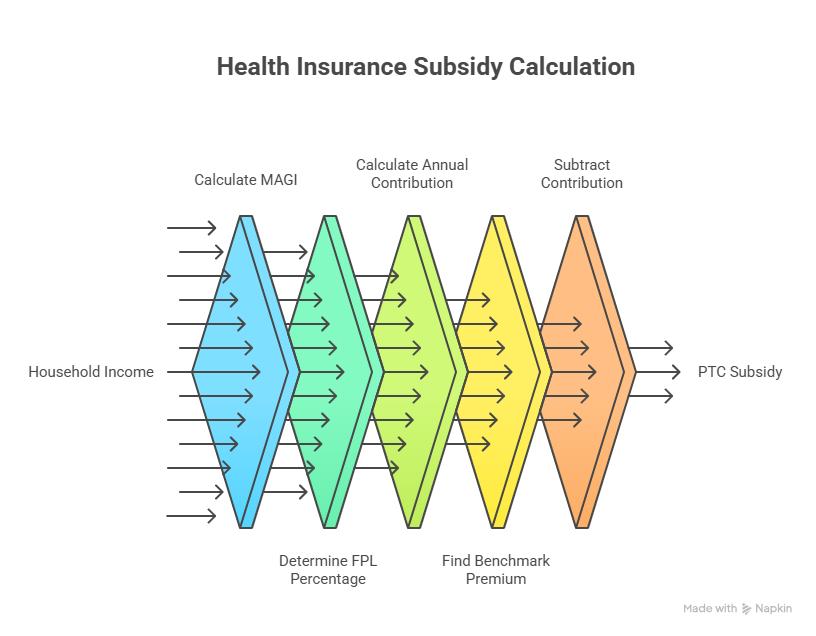

What Impacts Your Marketplace Subsidy? – Enterprise Cost-Saving Strategies & Buyer Intelligence

- Calculate MAGI and determine FPL percentage — based on household income and size.

- Identify expected contribution percentage using the FPL table.

- Multiply your MAGI by that percentage to get your annual contribution (what you’re expected to pay).

- Find the benchmark Silver plan premium in your location.

- Subtract your contribution from the benchmark plan cost—the result is your PTC subsidy.

- Apply the subsidy to any plan level, or use a Silver plan for cost-sharing reductions if eligible.

Estimating Marketplace health insurance costs involves a combination of your income, family size, age, location, and the plan’s metal tier. Subsidies aim to cap your contribution between 0%–8.5% of your income for a benchmark plan, with further cost-sharing reductions available for certain Silver plan enrollees. For personalized estimates, the KFF Marketplace Calculator is your best tool to understand what you could pay—and what help you might receive.

Consumers can use official calculators to estimate savings from tax credits and reductions.

Learn How Premium Tax Credits Help You Save

Premium tax credits are refundable credits applied to monthly insurance premiums:

- Lower monthly payments: Based on income relative to Federal Poverty Level

- Sliding scale: Ensures affordability for low to middle-income households

- Automatic application: Applied once eligibility is verified

- Maximizes coverage: Allows selection of higher-tier plans without financial strain

FAQs

What is the Best Health Insurance Marketplace Plan for Self-Employed Professionals in the US?

→ CPC Keyword: Best health insurance for self-employed USA

How Much Does Health Insurance from the Marketplace Cost Per Month in the UK?

→ CPC Keyword: Cost of marketplace insurance UK

Top 5 ACA Marketplace Services That Maximize Coverage & ROI for Enterprises

→ CPC Keyword: Top marketplace health services ROI

Marketplace Insurance vs Private Health Insurance – Which Offers Better Long-Term Growth?

→ CPC Keyword: Health insurance comparison marketplace vs private

ACA Marketplace Jobs in Canada – Growth Sectors & Future Trends

→ CPC Keyword: Health insurance marketplace jobs Canada

Health Insurance Marketplace Checklist – What Every Enterprise Buyer Must Know

→ CPC Keyword: Marketplace insurance checklist for buyers

How Does Marketplace Health Insurance Improve Employee Retention & Trust in Large Organizations?

→ CPC Keyword: Marketplace insurance employee trust ROI

Best ACA Marketplace Metal Tier for High Deductible Savings

→ CPC Keyword: Best metal tier ACA savings

Can I Claim Tax Credits Through the Health Insurance Marketplace in Australia?

→ CPC Keyword: Marketplace insurance tax credit Australia

How to Get ACA Health Insurance with the Highest Conversion Rate for Your Budget

→ CPC Keyword: High conversion ACA insurance plans