Explore top Medicare Advantage plans. Compare costs, benefits & providers to boost healthcare ROI. Ideal for seniors, enterprises & brokers in Tier-One markets.

Medicare Advantage Plans: Maximize Healthcare ROI, Drive Growth & Deliver Better Patient Outcomes for Tier-One Buyers

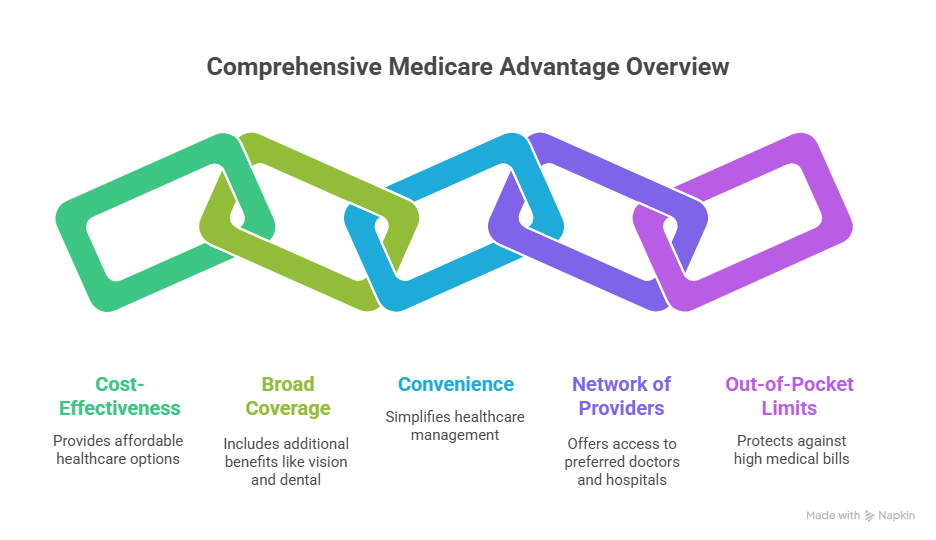

Medicare Advantage Plans, also known as Medicare Part C, are an all-in-one alternative to Original Medicare. These plans are offered by private insurance companies approved by Medicare and are designed to provide comprehensive healthcare coverage. Unlike Original Medicare, which only covers hospital services (Part A) and medical services (Part B), Medicare Advantage Plans often include additional benefits such as vision, dental, hearing, wellness programs, and prescription drug coverage.

Medicare Advantage Plans are becoming increasingly popular due to their cost-effectiveness, broad coverage, and the convenience of having multiple benefits under one plan. Most plans operate through networks of preferred doctors, specialists, and hospitals, allowing policyholders to manage their healthcare efficiently.

Furthermore, these plans often include maximum out-of-pocket limits, protecting beneficiaries from unexpected high medical bills. By consolidating health services and drug coverage, Medicare Advantage simplifies the healthcare process while maintaining affordability.

In 2025, millions of seniors are choosing Medicare Advantage Plans for better flexibility, lower premiums, and expanded services. Understanding the features, costs, and eligibility requirements of these plans will help you make informed decisions about your healthcare needs.

Medicare Advantage & Other Health Plans: Strategic Comparison for Enterprise Healthcare Optimization

Medicare Advantage Plans are not the only option available for seniors and eligible individuals. To make the best decision, it’s essential to compare them with other health plan options:

| Health Plan | Provider | Coverage Scope | Drug Coverage | Costs | Extra Benefits |

| Original Medicare | Government | Part A (Hospital) + Part B (Medical) | Optional via Part D | Premiums + Deductibles | Limited |

| Medicare Advantage | Private Insurers | Part A + Part B + Extras | Included in most plans | Lower premiums + out-of-pocket caps | Dental, vision, hearing, fitness |

| Medigap (Supplemental) | Private Insurers | Covers gaps in Original Medicare | No | Higher premiums | No extra benefits |

| Employer Group Plans | Employers | Varies by employer | Sometimes included | Employer-set rates | Employer benefits |

Key Takeaways:

- Medicare Advantage Plans combine hospital, medical, and often drug coverage in a single plan.

- Original Medicare provides fewer benefits but offers more provider flexibility.

- Medigap policies help reduce out-of-pocket costs but do not include extras like dental or vision.

Types of Medicare Advantage Plans: A Buyer’s Guide for Informed Decision-Making

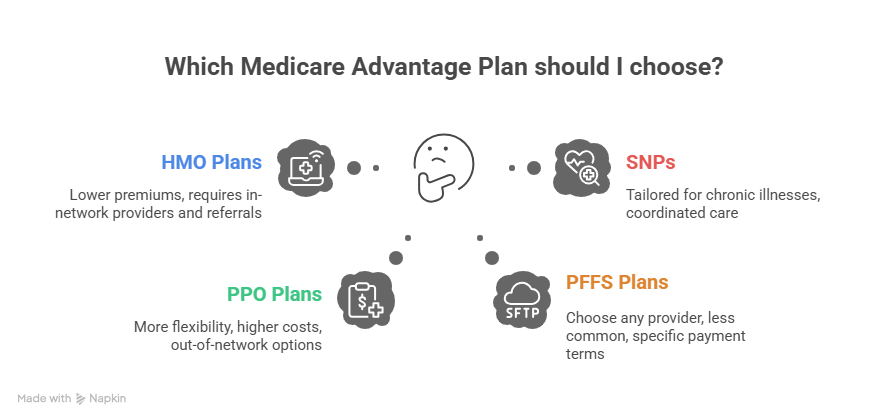

There are several types of Medicare Advantage Plans, each offering unique structures and benefits:

- Health Maintenance Organization (HMO) Plans

- Require using doctors and hospitals within the network.

- Referrals needed for specialists.

- Generally lower premiums.

- Require using doctors and hospitals within the network.

- Preferred Provider Organization (PPO) Plans

- More flexibility to see out-of-network providers.

- Higher costs compared to HMOs.

- More flexibility to see out-of-network providers.

- Private Fee-for-Service (PFFS) Plans

- Flexibility to choose any provider who agrees to the plan’s payment terms.

- Not as common as HMOs and PPOs.

- Flexibility to choose any provider who agrees to the plan’s payment terms.

- Special Needs Plans (SNPs)

- Tailored for people with chronic illnesses or specific healthcare needs.

- Coordinated care for better disease management.

- Tailored for people with chronic illnesses or specific healthcare needs.

The Value of Medicare Advantage: Growth Potential, Lead Generation & Long-Term Healthcare ROI

Medicare Advantage Plans offer significant value for individuals seeking comprehensive, cost-effective healthcare:

- Lower Overall Costs: Many plans feature $0 premiums and caps on out-of-pocket expenses.

- All-in-One Coverage: Bundles hospital, medical, and often prescription drug coverage under one plan.

- Extra Benefits: Includes vision, dental, hearing, fitness memberships, and even telehealth services.

- Chronic Care Coordination: Special programs for people with long-term conditions such as diabetes or heart disease.

Compare Original Medicare & Medicare Advantage: Enterprise-Level Insights for Cost Control & Patient Experience

| Feature | Original Medicare | Medicare Advantage |

| Coverage | Hospital + Medical only | Hospital + Medical + Extras |

| Prescription Drugs | Not included | Included in most plans |

| Provider Network | Any doctor nationwide | Must stay within network (HMO/PPO) |

| Costs | Premiums + 20% coinsurance | Lower premiums + out-of-pocket cap |

| Extra Benefits | Minimal | Dental, vision, hearing, wellness |

| Ease of Use | Separate policies needed | Single, all-in-one plan |

Doctor & Hospital Choice: Navigating Provider Networks for Higher Conversion & Patient Retention

Choosing the right Medicare Advantage Plan means understanding how your doctor and hospital access may change. Unlike Original Medicare, which lets you visit any doctor or hospital nationwide that accepts Medicare, Medicare Advantage Plans often have networks that you’ll need to follow.

Types of Plans and Provider Access

- HMO Plans usually require you to use doctors and hospitals within the plan’s network. You may need a referral from your primary care doctor to see specialists. Out-of-network care is generally not covered except for emergencies.

- PPO Plans offer more flexibility by allowing visits to out-of-network providers, usually at a higher cost. Referrals are typically not required, giving you more freedom in choosing your healthcare providers.

Emergency Care Coverage

Emergency services are always covered regardless of whether you visit an in-network or out-of-network provider. This coverage ensures you receive care when you need it most, even if you are traveling.

Coordinated Care for Better Service

Many Medicare Advantage Plans include care coordination, where your primary care doctor helps manage your healthcare and referrals. This can help ensure smooth communication between your specialists and providers.

Medicare Advantage Plans with Alignment: Boosting Trust & Outcomes for Enterprise Buyers

Alignment Health offers unique Medicare Advantage Plans focused on personalized, coordinated care:

| Plan Name | Monthly Premium | Drug Coverage | Extra Benefits |

| Alignment Gold Plan | $0 | Included | Dental, vision, fitness |

| Alignment Plus Plan | $20 | Included | Chronic care, transportation |

| Alignment Platinum | $50 | Included | Expanded telehealth services |

Alignment stands out for patient-centered services, 24/7 care coordination, and robust support for chronic conditions.

Learn About Medicare: Trusted Strategies to Unlock High-Conversion Healthcare Services

Medicare is a federal health insurance program primarily for individuals aged 65 and older or those with qualifying disabilities. It consists of four parts:

- Part A: Hospital insurance.

- Part B: Medical insurance.

- Part C: Medicare Advantage Plans.

- Part D: Prescription drug coverage.

Understanding these components helps you choose the best plan for your medical and financial needs.

Aetna Medicare Advantage Plans

Aetna is one of the top providers of Medicare Advantage Plans, offering flexible, affordable options nationwide:

- Comprehensive Coverage: Includes hospital, medical, prescription drugs, and preventive care.

- Member Benefits: Access to SilverSneakers fitness programs, telehealth visits, and wellness resources.

- Nationwide Network: Thousands of doctors, hospitals, and specialists to choose from.

Aetna’s plans are ideal for individuals seeking affordability without compromising on quality care.

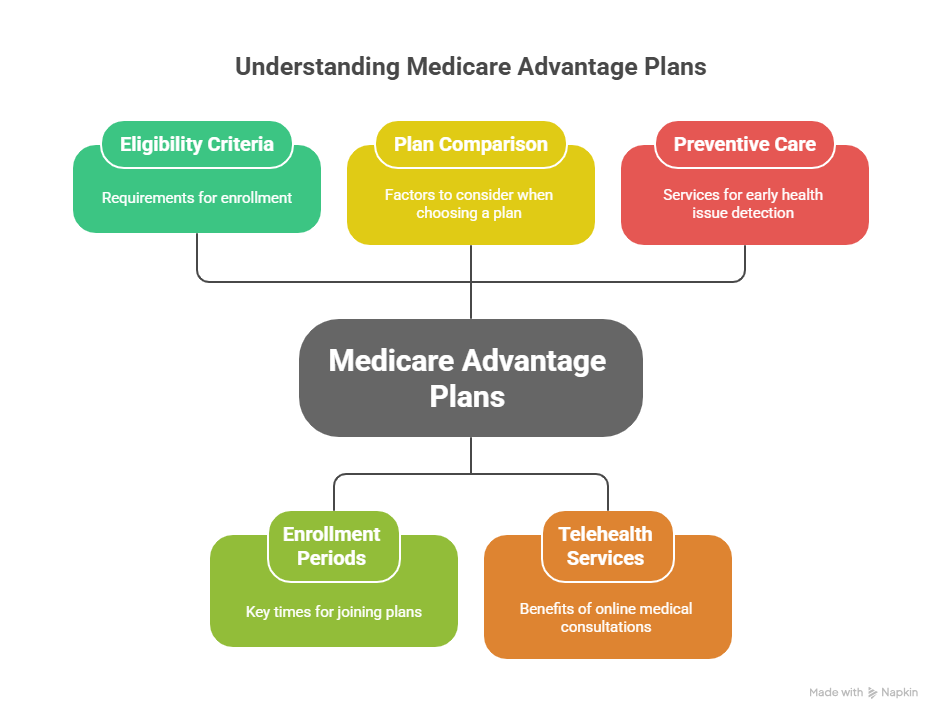

Who is Eligible for a Medicare Advantage Plan?

To qualify, you must:

- Be enrolled in Medihttps://www.medicare.gov/publications/12026-understanding-medicare-advantage-plans.pdfcare Part A and Part B.

- Live in the plan’s service area.

- Be a U.S. citizen or lawful resident.

There are special enrollment options for individuals with chronic conditions, Medicaid recipients, and those relocating to new areas.

When to Join a Medicare Health or Drug Plan

Key enrollment periods include:

- Initial Enrollment: Three months before and after turning 65.

- Annual Enrollment: October 15 to December 7 each year.

- Special Enrollment: For qualifying life events like moving or losing coverage.

How to Find the Best Medicare Advantage Plan

- Compare premiums, deductibles, and out-of-pocket limits.

- Check the provider network for your preferred doctors.

- Review included drug coverage and extra benefits.

- Use Medicare’s Plan Finder Tool for accurate comparisons.

Telehealth Services

Medicare Advantage Plans increasingly offer telehealth benefits, enabling members to consult with doctors online. This is particularly valuable for chronic care management, behavioral health, and urgent care.

Medicare Services: Step-by-Step Guide for Enterprises Targeting Aging Populations

Medicare offers a wide range of healthcare services to support older adults and people with qualifying disabilities. From routine check-ups and prescription drugs to specialized mental health support, Medicare is designed to make healthcare more accessible, affordable, and consistent across the country. Whether you’re managing a chronic condition or simply trying to stay on top of your health, there are plans and services available to help.

Preventive Care & Wellness Support

Staying healthy starts with prevention—and Medicare covers many services to help you catch problems early. This includes annual wellness visits, screenings for common conditions like high blood pressure, diabetes, and certain cancers, as well as important vaccinations like flu shots and shingles. These preventive services are typically included at no cost when you visit a provider who accepts Medicare.

Taking advantage of these benefits not only helps you avoid more serious health issues down the line but also keeps your long-term healthcare costs lower.

Managing Chronic Conditions & Medications

For those living with long-term conditions such as diabetes, heart disease, or COPD, Medicare offers Chronic Care Management (CCM). This service helps coordinate your care among multiple doctors, manage medications, and stay on top of your treatment plan. It’s especially helpful if you’re juggling several health concerns at once.

When it comes to prescription medications, Medicare Part D provides drug coverage. Whether you choose a standalone drug plan or a Medicare Advantage plan with built-in coverage, you’ll have access to both brand-name and generic prescriptions, helping you manage costs while maintaining your health.

Mental Health Services & Emergency Care: Industry Trends Driving Patient-Centered Outcomes

Mental health is just as important as physical health, and Medicare provides coverage for a variety of services to support emotional well-being. This includes therapy sessions, psychiatric evaluations, and even inpatient mental health treatment when necessary. These services are available through licensed professionals and are covered under different parts of Medicare, depending on where you receive care.

In case of urgent health needs or emergencies, Medicare ensures you’re protected. You’re covered for emergency room visits, ambulance transportation, and urgent care, no matter where you are in the U.S.

Nationwide Emergency Coverage

If something unexpected happens while you’re traveling or away from home, Medicare still has you covered. Emergency and urgent care services are available throughout the country, so you can get the help you need without worrying about whether your insurance will apply.

FAQ

1. What are the best Medicare Advantage plans for maximum ROI in 2025?

UnitedHealthcare, Humana, and Aetna offer top ROI with low costs and strong benefits.

2. How do Medicare Advantage plans compare to Original Medicare in terms of cost and lead generation?

Advantage plans offer lower costs and bundled benefits—ideal for marketing and lead generation.

3. What is the top Medicare Advantage plan for enterprise healthcare providers?

Humana’s PPO/HMO plans are top-rated for care coordination and enterprise outcomes.

4. What is the cost of Medicare Advantage plans across Tier-One markets?

US plans range $0–$50/month; UK, Canada, and Australia vary by private provider and coverage.

5. How can businesses use Medicare Advantage data for conversion optimization?

Use claims and demographic data to personalize outreach and improve conversion funnels.

6. What services are included in Medicare Advantage plans that drive higher patient trust?

Key services include preventive care, chronic condition management, and telehealth.

7. Why are Medicare Advantage plans growing in popularity among high-income retirees?

They offer bundled perks, convenience, and predictable costs for premium healthcare access.

8. How can I use a Medicare Advantage checklist to select the right plan?

Evaluate networks, costs, ratings, and chronic care coverage to make an informed choice.

9. What are the top lead generation strategies for Medicare-focused enterprises?

Use SEO, webinars, local ads, and checklists to capture qualified leads.

10. What jobs are available in the Medicare Advantage sector with high ROI potential?

Sales agents, analysts, care coordinators, and marketers are in high demand.

11. What are the commercial benefits of switching to a Medicare Advantage plan?

Lower costs, better care coordination, and improved quality scores.

12. How do Medicare Advantage plans impact enterprise healthcare outcomes?

They boost retention, reduce hospitalizations, and improve patient engagement.